A new presidential policy imposes tariffs on semiconductor imports, aiming to bolster national security but stirring debates on economic impacts.

Story Highlights

- 25% tariff introduced on specific semiconductor imports to protect U.S. national security.

- The measure aims to reduce reliance on foreign sources, particularly for AI-enabling chips.

- Exemptions exist for U.S. data centers and innovation-related imports.

- Negotiations with foreign jurisdictions underway to address trade concerns.

Trump’s Tariff on Semiconductor Imports

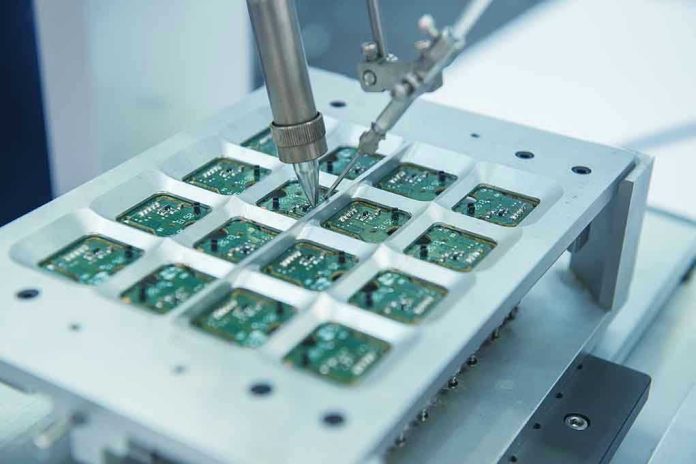

On January 14, 2026, President Donald Trump signed a proclamation, invoking Section 232 of the Trade Expansion Act of 1962, to impose a 25% tariff on certain semiconductor imports. This bold move aims to safeguard U.S. national security by reducing dependency on foreign suppliers, notably Taiwan, for essential AI-enabling chips. The strategy not only seeks to strengthen domestic production but also to leverage trade negotiations to achieve a more balanced semiconductor supply chain.

The new tariffs are part of a two-phase plan designed to bolster U.S. self-sufficiency in semiconductor manufacturing. Phase one involves immediate tariff imposition, while phase two, contingent on negotiation outcomes, could expand tariffs further. Exemptions have been carved out for imports that fuel American innovation, including those destined for data centers, research and development, and other strategic sectors.

Stakeholders and Their Roles

The imposition of these tariffs has significant implications for key stakeholders. President Trump, alongside the Secretary of Commerce and the U.S. Trade Representative, is at the forefront of this policy initiative. Their objective is clear: to enhance national security and incentivize domestic semiconductor manufacturing, aligning with Trump’s “America First” vision. Major industry players like Nvidia and AMD are navigating these changes, as the tariffs impact their operations and export strategies.

Negotiations with foreign jurisdictions are ongoing, with a report due in 90 days to update the President on progress. Companies like Nvidia, which designs chips manufactured by Taiwan’s TSMC, are particularly affected, as tariffs may apply to their China exports, impacting transshipment duties.

Economic and Industry Impacts

The economic implications of these tariffs are profound. In the short term, they might lead to increased costs for non-exempt imports, yet they also generate revenue through transshipment duties. In the long run, the policy is expected to catalyze domestic investment, potentially exceeding $100 billion, thus reducing reliance on foreign suppliers and fortifying U.S. supply chains.

However, there are concerns about potential supply shortages and retaliatory measures, particularly from China, which could escalate trade tensions further. While the exemptions protect crucial areas like AI and data centers, the broader industry must adapt to these changes, balancing between innovation and security needs.

The move has sparked discussions among industry experts and policymakers. Some advocate for these measures as necessary to secure supply chains and reduce vulnerabilities, while others caution against possible innovation slowdowns and economic disruptions. The tariffs, though a significant step towards national security, bring with them a host of economic and political challenges that will require careful navigation in the coming months.

Sources:

White House: Adjusting Imports of Semiconductors

Sharecafe: US Imposes Tariff on Semiconductor Imports

WKZO: Trump Imposes 25% Tariff on Advanced Chips

Construction Dive: US-China Semiconductor Tariffs 2027